Investment strategy

Creaspac’s acqusition strategy is to identify and complete an acquisition of a company that can create value for the shareholders over time and that is expected to acquire a target company with approximately SEK 2-5 billion in enterprise value (excluding indebtedness).

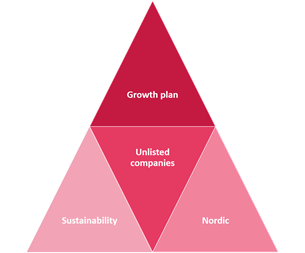

Creaspac’s overall acquisition strategy is to seek to acquire a company with significant potential for revaluation and the ability to generate profit growth, taking into account risk. Potential target companies include primarily Nordic, unlisted companies with businesses that are relatively predictable, for example in terms of customer behaviour, industry structure and technology development.

Creaspac’s acquisition strategy is not to acquire companies active in oil, gas, coal, tobacco, alcohol, weapons, real estate, betting, advanced biotechnology, mining or companies whose value is largely dependent on commodity prices or other exogenous macro factors, nor companies that are exposed to significant political or regulatory risk, however, Creaspac’s strategy is not limited to acquiring a company in one or a few specific industries or sectors either.

Although Creaspac, as stated above, in accordance with its acquisition strategy is not limited to acquire a company in one or a few specific industries or sectors, Creaspac’s sponsor Creades, whose investment organisation also assists Creaspac with transaction related advisory services, has investment experience and good knowledge about companies within financial services, e-commerce and related services, software/SAAS companies, gaming (games, not betting) and industrial companies within consumer goods.

The activity of a potential investment increases with a low valuation in combination with an attractive plan to implement measures that can create additional value through active ownership. As an illustration, such a plan may include one or more of the following measures:

- Growth plan: Efforts to increase the growth of products or services by expanding the market to new customer groups, sales channels or geographical markets, as well as through additional acquisitions.

- Operational improvements: Measures to streamline and rationalise product or service offerings, reduce production costs, or increase measurability and follow-up through, for example, better IT solutions.

- Structural changes: Create value by questioning and changing existing structures, through, for example, acquisitions, optimisation of production or sales organisations, division of businesses or sales of divisions or products and services outside the company’s core area.

- Financial changes: Initiate and assist in the implementation of changes to the company’s capital structure in order to achieve maximum competitiveness in combination with higher shareholder value.

Sustainability

Creaspac shall, in the evaluation of an acquisition, assess whether the target company is able to comply with Creaspac’s sustainability policy. The acquisition analysis also includes identification of risks and opportunities from a sustainability perspective with a focus on value creation opportunities by introducing sustainable business models, climate-compatible production and distribution, or otherwise increase the company’s value by implementing an increased sustainability focus. Creaspac believes that it increases the Company’s business case that sustainability issues constitute an integral part of the its business as an acquisition company and thus form part of the Company’s acquisition strategy. Creaspac sees the importance of sustainable development as a structural trend in society that benefits the businesses and business models that are in line with and benefit from an increased sustainability focus, which can thereby increase the attractiveness of a potential acquisition. The acquisition analysis also assesses the adherence to laws and regulations and how the acquisition object relates to the UN Global Compact’s ten principles. Creaspac will ensure that companies that are acquired meet these requirements.

Readiness for the stock exchange

The potential acquisition is also evaluated from the perspective of whether the company will be able to meet Nasdaq Stockholm’s or Nasdaq First North Growth Market’s listing requirements within a reasonable time. Nasdaq Stockholm’s listing requirements include that the target company must meet basic conditions such as having a sufficient financial and business history, documented earnings capacity, proven business model and a sufficiently qualified organisation for a listed environment, while Nasdaq First North Growth Market’s listing requirements are lower in these respects.

As part of the evaluation of a target company, Creaspac will carry out an assessment and analysis of the target company’s readiness to be in the stock exchange to identify the circumstances that need to be addressed in order to meet the listing requirements. This can also include appropriate reinforcements in management functions and the wider organisation. Prior to any acquisition, the legal review, and review of the target company’s tax situation, is intended to be conducted so that the result of these reviews can, with minor additions, be used in the subsequent listing process. The objective is to have, at the time an acquisition agreement is entered into, a completed assessment of the target company’s readiness to be in the stock exchange and a clear action plan to fully comply with the listing requirements, which can be executed immediately after the acquisition agreement is entered into and before the review process with Nasdaq Stockholm or Nasdaq First North Growth Market is initiated.