What is a SPAC?

A Special Purpose Acquisition Company (SPAC), is a company with no operational history, with the objective to raise capital through an initial public offering and within a certain period of time thereafter, normally 24 to 36 months, acquire an unlisted company which thereby becomes listed, after a certain review process. The initiator of a SPAC is a so-called sponsor and is responsible for identifying, analysing and completing the acquisition.

Introduction to special purpose acquisition companies

The market for investments in unlisted companies has gradually increased in importance, measured as a share of global capital under management. In 2012, the share amounted to 6 percent, in 2020 the share amounted to 9 percent and in 2025, 11 percent of total capital under management is expected to be allocated to unlisted companies. As the market for unlisted companies has grown, there has been increased interest from investors on the public market to find ways to acquire and subsequently own unlisted assets in a transparent and listed environment. One way of achieving this is to acquire a holding in a SPAC being listed on a stock exchange and which, under the direction of a professional and established investor, acquires an unlisted company. At the same time, a SPAC offers sellers of unlisted companies an attractive alternative to both a traditional stock exchange listing and a private sale, inter alia by offering flexibility as to the proportion of shares the seller can divest, a higher degree of transaction security compared to a traditional stock exchange listing as well as access to the capital market and a well-established and long-term owner.

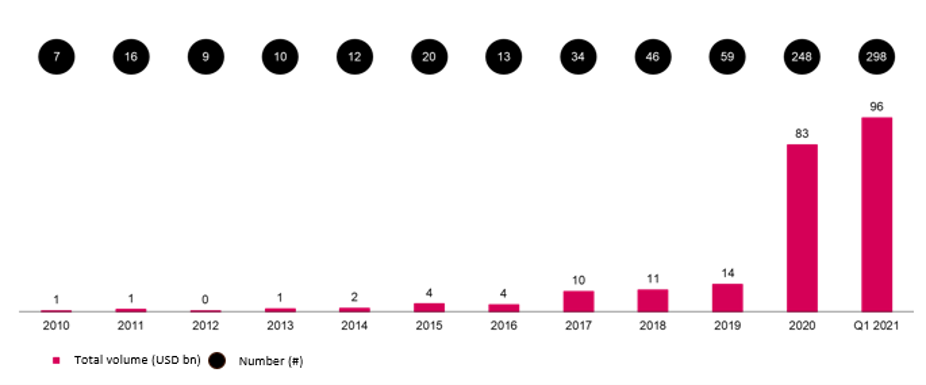

In recent years, SPACs have had a significant break-through in the United States. In 2020, over 200 SPACs became listed on stock exchanges in the United States, which corresponds to approximately 50 percent of the total number of companies listed on stock exchanges in the United States during the period. In 2020, institutional and private investors invested a total of over USD 80 billion in US-based SPACs, and over USD 90 billion during Q1 2021.

SPACs have not yet had the same breakthrough in Europe, although the activity relating to SPACs has increased during the past months in certain European markets. In 2020, six acquisition companies were listed in Europe (four in the United Kingdom, one in the Netherlands and one in France) and during Q1 2021 seven acquisition companies were listed in Europe (three in the United Kingdom, two in the Netherlands, one in Sweden and one in Luxembourg).

In Sweden, the first SPAC was listed on Nasdaq Stockholm in March 2021. The current provisions in Nasdaq Nordic Main Market Rule Book for Issuers of Shares that specifically regulate SPACs entered into force on 1 February 2021. Given the significant breakthrough of SPACs in the United States recently, as well as the new rules that came into force on 1 February 2021, an increased interest in establishing SPACs in the Swedish market can be expected, which over time may increase the competitive landscape for SPACs in Sweden and require differentiation in terms of size, investment criteria and other profiling. Although the Swedish model is largely based on the American equivalent, the Swedish model, the rules that apply to SPACs in Sweden or the conditions applied by SPACs in Sweden, including Creaspac, are not necessarily the same as those that apply in the United States or in any other country where SPACs also have been established.

Regulations for SPACs

In Sweden, listed SPACs are primarily regulated by provisions in the Nasdaq Nordic Main Market Rulebook for Issuers of Shares.